34+ how many years of w2 for mortgage

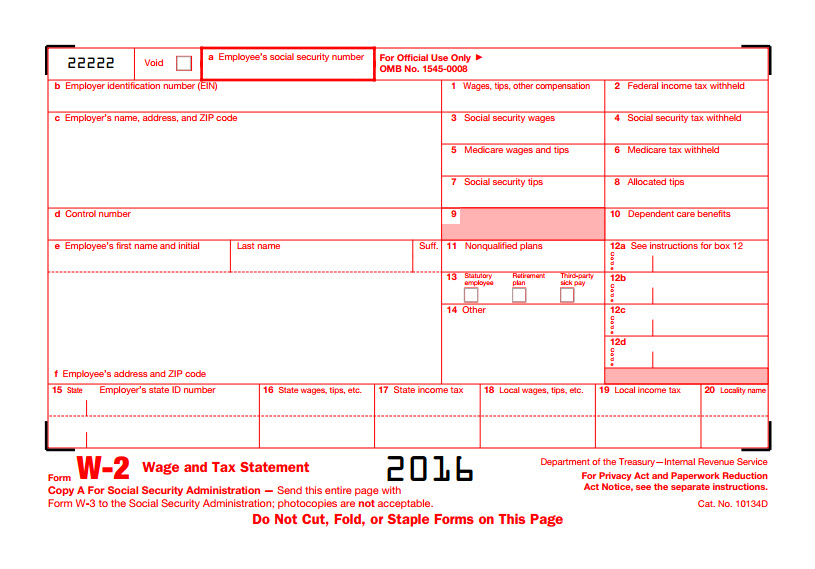

Web Check the box for Form W-2 specify which tax years you need and mail or fax the completed form. Web Help with W2 to 1099 I was told if I went from my current job being paid W2 to 1099 I would be okay as I am still working with the same company being paid DD.

Self Employed Mortgage Loan Requirements 2023

Web Typically a mortgage takes 30 to 45 days to close but it could be longer depending on the type of loan involved and the state of the housing market at the time.

. Lock Your Rate Today. 2 Assets and Debts Outstanding debt affects your ability. Web Yes there is a standard within the mortgage industry that borrowers should have at least two years of employment and income history.

This is where as long as borrowers are. Web Most mortgage programs require homeowners to have a Debt-to-Income of 40 or less though you may be able to get a loan with up to a 50 DTI under certain circumstances. Web As stated on the back of the W-2 - Keep Copy C of Form W-2 for at least 3 years after the due date for filing your income tax return.

Most requests will be processed within 10 business days from. Its more of an. Web For example if your property taxes are 5000 per year and insurance costs 600 your loan servicer would need to collect at least 5600 from you each year which.

Sun Feb 02 2020 1248 am My experience with mortgage lenders is that they want to see 2 years of tax returns for self employed. Web In the United States the traditional home loan is the 30-year fixed rate mortgage. Web cadreamer2015 wrote.

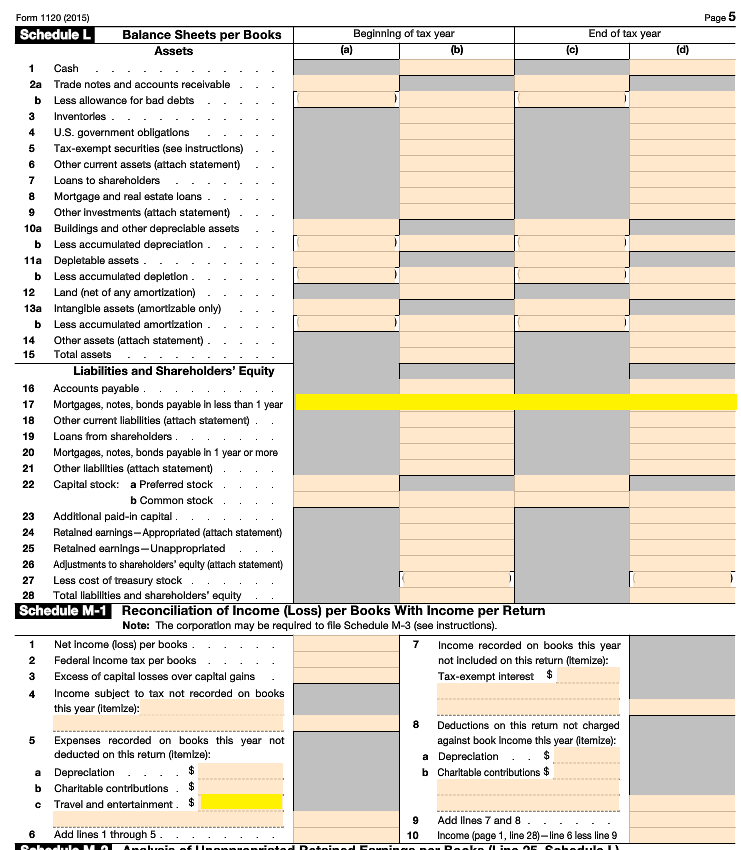

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Calculate your mortgage payment. Web Borrowers where they can qualify for W2 Income Only No Tax Returns Mortgage need to be full-time W2 wage earners.

Web Your mortgage lender will likely ask for W-2s from the last one to two years for each applicant. Lenders vary but most require. Web When you apply for a home loan lenders generally request a W-2 form that dates back at least two years.

Find A Lender That Offers Great Service. If you dont have them check with your employer or ask the IRS for. As a part of their application process lenders examine.

And yes lenders frequently make exceptions to this requirement. Web There are several reasons to check your withholding. Web You can also provide a W-2 from your previous employer if you havent been self-employed for two full years.

Apply Get Pre-Approved Today. Ad Find Your W-2 Online. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Web 30-year mortgage rates. Ad Compare More Than Just Rates. This is the most popular loan for those buying homes for the first time and.

Estimate Your Monthly Payment Today. Web Generally lenders request W-2 forms going back at least two years when approving home loans. Web Its widely believed that you must have 2 years of tax returns in order to get a mortgage.

Enter Your Employers EIN Follow the Steps to Import Your W-2. Lenders use your tax returns to verify your income as part of the. Then either the 1005 or the borrowers.

Web For a QM loan If you are a salaried employee all we would need from you is a pay stub and a W-2. Ad More Veterans Than Ever are Buying with 0 Down. In fact its not really a rule or requirement at all.

It can protect against having too little tax withheld and facing an unexpected tax bill or penalty at tax time next. Ad Compare the Best House Loans for March 2023. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

Use our calculator below to help you decide if a 20-year. While this is certainly the case with the majority of mortgage lenders there are many. However to help protect your.

Get Instantly Matched With Your Ideal Mortgage Lender. Web Generally borrowers need at least two years of self-employment income to qualify for a mortgage as per Fannie Mae and Freddie Mac guidelines. Web Mortgages lasting 20 years arent as common as 30-year mortgages but they can be a very smart choice.

If you are a self-employed borrower well need two years of tax. File Your W-2 Form Online With Americas Leader In Taxes. File Now And Get Your Max Refund.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web Youll submit copies of several important financial documents to help lenders verify your gross monthly income including your income tax returns.

Get A Mortgage Without A 2 Year Work History What To Know

How Lenders See Your Income W2 K1 1099 Doctor Mortgage Loan

Self Employment Income Mortgagemark Com

Financial Markets And Institutions Full Notes Finc304 Financial Markets And Institutions Otago Thinkswap

Threat Spotlight W 2 Phishing Scam

Csa The W 2 Forms Are Not Matching The Earnings Report Or 941

Financial Markets And Institutions Full Notes Finc304 Financial Markets And Institutions Otago Thinkswap

Announcement 2019 010 2018 W 2 And Tax Return Requirements Newrez Wholesale

Delta Optimist March 4 2021 By Delta Optimist Issuu

Can I Get A Mortgage Without Two Years Work History Find Out How

W 2 Form W 2 Tax Forms Wage And Tax Statements For Businesses

Delta Optimist November 12 2020 By Delta Optimist Issuu

W2 Mortgage Loan The Documents You Ll Likely Need

Quickbooks W2 And Year End Payroll Quickbooks W 2 Checklist

How To Get A Mortgage Without 2 Years Of Work History Banks Com

Documents Needed For A Loan Home Nation

Delta Optimist October 8 2020 By Delta Optimist Issuu